The European Investment Bank (EIB) has expanded its Sustainability Awareness Bond (SAB) to support gender equality and women’s economic empowerment. Funds will finance women-led businesses, employment opportunities, and gender-focused projects. The initiative aligns with global gender-lens investing standards, ensuring transparency and measurable impact through audited reporting and EU-aligned criteria.

The European Investment Bank (EIB) has expanded the scope of its Sustainability Awareness Bond (SAB) to include gender equality and women’s economic empowerment. This development marks a significant step in mobilising capital markets to advance social objectives and aligns with the broader global movement towards gender-inclusive financing.

The extension of the SAB framework allows proceeds from these bonds to be allocated to projects supporting women-owned businesses, increasing employment opportunities for women, and developing services that address gender-specific needs. These projects will be implemented across various regions, including Kenya, France, Armenia, and Denmark.

EIB President Nadia Calviño highlighted the economic and social impact of this initiative, stating:

“Investing in women entrepreneurs and gender equality is not only the right thing to do but also the smart thing to do. Gender equality brings growth, prosperity to our economies. The extension of our Sustainability Awareness Bond shows how we can mobilise capital markets and deploy sustainable finance to do this.”

Gender-lens investing and capital market participation

This move by the EIB has been met with strong support from the financial and investment community. Julie Becker, Chief Executive Officer of the Luxembourg Stock Exchange, underscored the importance of integrating gender dimensions into financial instruments:

“We applaud the EIB’s decision to expand its Sustainability Awareness Bond Framework to include a gender dimension, and we hope many other issuers will take inspiration from this important move. Women play an essential role in driving societal progress and sustainable development. In the current context, marked by the rollback of gender equality programmes in certain regions, advancing financing for women has become more urgent than ever.”

Jessica Espinoza, Chief Executive Officer of 2X Global, emphasised the importance of structured gender-lens investing to ensure measurable impact:

“Capital markets have a pivotal role to play in mobilizing investments for gender equality. By adopting robust gender lens investing standards and criteria, such as the 2X Criteria, we can unlock gender-smart capital at scale and drive real change. These standards not only provide a unified framework for investors but also ensure that impact investments and gender-focused bonds truly deliver on their promises. As we’ve seen with the 2X Challenge, which has raised over $34 billion in gender lens investments since 2018, when we align capital with clear, measurable gender criteria, we can accelerate progress towards a more equitable world.”

Sustainability awareness bonds: Enhancing social and environmental impact

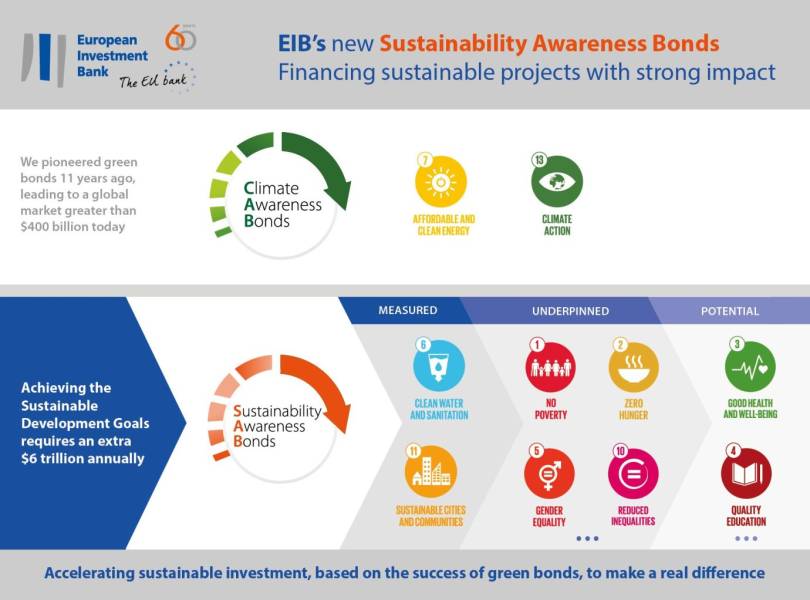

Launched in 2018, the Sustainability Awareness Bond was introduced to expand on the success of the Climate Awareness Bond. Initially, these bonds focused on financing environmental and social projects, including biodiversity protection, clean water access, education, healthcare, and social housing infrastructure. With the newly added focus areas, proceeds from these bonds can now also support:

- Women-owned and women-led businesses, including Micro, Small and Medium Enterprises (MSMEs) and mid-sized firms.

- SMEs and mid-sized companies that promote gender diversity through employment opportunities for women.

- Projects that deliver services or products specifically designed to close gender equality gaps, such as maternal vaccines and healthcare initiatives.

The EIB has structured the eligibility criteria of these bonds in alignment with ICMA’s Sustainability Bond Guidelines and the EU Taxonomy, ensuring that investments contribute directly to the United Nations Sustainable Development Goals (SDGs). The gender eligibility criteria follow established frameworks, including the 2X Criteria, the EU Directive 2022/2381 on gender balance, and the OECD-DAC Gender Equality Policy Marker.

Commitment to transparency and impact measurement

A key aspect of the EIB’s approach is ensuring transparency and accountability in how the bond proceeds are used. The bank commits to detailed audited reporting on project financing and outcomes, with oversight from a supervised auditor. This approach ensures that investors can track the measurable impact of their contributions towards gender equality and women’s economic empowerment.

The EIB’s commitment to gender equality extends beyond its financing activities. The institution has adopted a Strategy on Gender Equality and Women’s Economic Empowerment, integrating these principles across its lending, blending, and advisory services. The bank is also actively promoting gender diversity within its own workforce.

EIB’s broader role in sustainable finance

As the financing arm of the European Union, the EIB has been at the forefront of sustainable and responsible investment. In 2007, the institution launched the world’s first green bond and has since aligned its financing with the EU Taxonomy and the European Green Bond Standard. By August 2024, the EIB had surpassed the €100 billion mark in Climate Awareness Bond and Sustainability Awareness Bond issuance, reinforcing its position as the world’s largest issuer of green and sustainability bonds among multilateral development banks.

In 2024, the EIB signed nearly €89 billion in new financing for over 900 projects, mobilising an estimated €350 billion in investment. These projects are expected to support 400,000 companies and create or sustain 5.8 million jobs worldwide.

By integrating gender equality and women’s economic empowerment into its Sustainability Awareness Bond framework, the EIB is taking a significant step towards achieving economic and social transformation. This initiative aligns with broader global efforts to ensure that sustainable finance actively contributes to creating a more inclusive, equitable, and resilient economy.

Pallavi Singal is the Vice President of Content at ztudium, where she leads innovative content strategies and oversees the development of high-impact editorial initiatives. With a strong background in digital media and a passion for storytelling, Pallavi plays a pivotal role in scaling the content operations for ztudium’s platforms, including Businessabc, Citiesabc, and IntelligentHQ, Wisdomia.ai, MStores, and many others. Her expertise spans content creation, SEO, and digital marketing, driving engagement and growth across multiple channels. Pallavi’s work is characterised by a keen insight into emerging trends in business, technologies like AI, blockchain, metaverse and others, and society, making her a trusted voice in the industry.